The Federal Reserve cut interest rates by 25 basis points on Wednesday, October 29, 2025, lowering the federal funds rate to a range of 3.75%-4.00%—but don’t expect your mortgage rate to automatically drop. While the Fed’s second rate cut of 2025 has contributed to mortgage rates falling to their lowest levels in over a year, the relationship between Fed policy and home loan rates remains complex and indirect, leaving many borrowers wondering whether now is the right time to buy or refinance.

Read Also: Suns vs Grizzlies Game Preview: Phoenix Aims to End Three-Game Losing Streak

The Fed’s Latest Rate Decision: Key Details

The Federal Open Market Committee (FOMC) voted 10-2 to approve the quarter-point reduction, marking the second consecutive rate cut this year following a similar move in September. Fed Chair Jerome Powell cited concerns about a “weakening labor market” and elevated economic uncertainty as primary reasons for the cut, despite inflation remaining “somewhat elevated” at 3%—above the Fed’s 2% target.

In a notable split, two FOMC members dissented: Stephen Miran voted for a larger 50 basis point cut, while Jeffrey Schmid preferred no change at all, highlighting divisions within the committee about the appropriate policy path. The Fed also announced it will conclude the reduction of its securities holdings on December 1, 2025, essentially ending its quantitative tightening program.

However, Powell threw cold water on expectations for a December rate cut, stating it is “far from a foregone conclusion,” causing markets to reassess the likelihood of further monetary easing this year.

Read Also: Jin Biography: The Handsome Voice of BTS

Current Mortgage Rates: One-Year Lows Offer Relief

Despite the Fed’s cautious tone about future cuts, mortgage rates have dropped significantly in recent weeks. As of October 30, 2025, the average 30-year fixed mortgage rate stands at 6.19%-6.26%, depending on the survey—the lowest level in more than a year.

Today’s Mortgage Rates (October 30, 2025)

Purchase Rates:

- 30-year fixed: 6.19%-6.26%

- 15-year fixed: 5.44%-5.63%

- 30-year FHA: 6.58%

- 30-year VA: 5.74%-6.64%

- 30-year Jumbo: 6.30%-6.39%

- 5/1 ARM: 5.50%-6.61%

Refinance Rates:

- 30-year fixed refinance: 6.49%-6.55%

- 15-year fixed refinance: 5.81%-5.87%

- 10-year fixed refinance: 5.93%-6.25%

This represents a substantial improvement from the beginning of 2025, when 30-year rates hovered above 7%, and a dramatic drop from October 2024’s average of 6.54%.

Read Also: RM Biography: The Inspiring Journey of BTS’s First Member

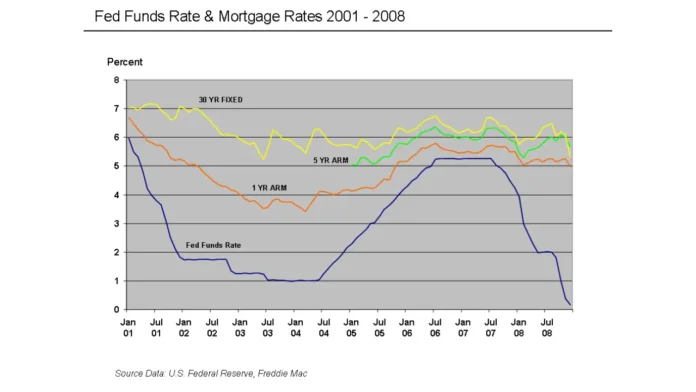

Why Mortgage Rates Don’t Automatically Follow Fed Cuts

Many homebuyers assume that when the Fed cuts rates, mortgage rates will immediately fall. The reality is more complicated.

The 10-Year Treasury Connection

Fixed-rate mortgages—particularly the popular 30-year loan—don’t track the Fed’s federal funds rate directly. Instead, they follow the 10-year Treasury yield, which reflects broader market expectations about inflation, economic growth, and future Fed policy.

“There is not a one-to-one correlation between the Fed Target Rate, which was lowered by 25%, and 30-year mortgage rates,” explained William T. Chittenden, finance expert at SMU Cox School of Business.

The 10-year Treasury yield currently sits at approximately 3.98%-4.00%, down from 4.19% a year ago. When Treasury yields fall, mortgage lenders can offer lower rates because the cost of capital decreases. But this relationship isn’t automatic or immediate.

Read Also: Skoda Octavia RS Limited Edition: The Fun Performance Car India Has Been Waiting For

Why Rates Sometimes Rise After Fed Cuts

Paradoxically, mortgage rates can actually increase following a Fed rate cut if markets interpret the cut as a sign that inflation might accelerate or if Treasury yields rise due to other economic factors.

After the Fed’s September 2025 rate cut, 30-year mortgage rates initially rose from 6.3% to 6.39%, where they remained for three weeks before declining. Similarly, following the October 29 announcement, the 10-year Treasury yield shot up past 4%, potentially signaling upward pressure on mortgage rates in the coming days.

“After the announcement, yields on the 10-year Treasury bond shot up past 4 percent after hovering below that threshold for much of the past two weeks,” noted Bankrate analysts.

Expert Predictions: What to Expect for Mortgage Rates

Short-Term Outlook (November 2025)

Ralph DiBugnara, president at Home Qualified, predicts rates will rise slightly: “Mortgage rates have stayed pretty steady around 6.25% for a 30-year fixed… I believe the 30-year fixed rate will average 6.375% [in November] with the 15-year fixed averaging 5.99%“.

Charles Goodwin, head of lending at Kiavi, expects rates to moderate: “I expect mortgage rates will hold relatively steady, fluctuating within a narrow range of 25 to 50 basis points… The most likely scenario is a modest downward drift in interest rates”.

Selma Hepp, chief economist at Corelogic, remains optimistic: “Lower mortgage rates are a good thing for potential homeowners and the Fed is continuing its slow and steady approach to reducing the cost of mortgage lending… It is widely expected that the Fed will reduce rates one more time this year”.

Long-Term Forecast (2025-2026)

Most housing economists expect mortgage rates to remain above 6% through the end of 2025, with potential gradual declines into 2026 if inflation continues cooling and the Fed proceeds with additional cuts.

Freddie Mac’s November Economic Outlook predicts mortgage rates will decline in 2025, leading to increased refinance activity and modestly higher overall mortgage origination volumes.

However, Zillow Home Loans projects rates will end 2025 in the mid-6% range, suggesting limited near-term relief for borrowers hoping for sub-6% rates.

Read Also: New Mahindra Thar Facelift: Rugged Charm Meets Modern Comfort at Just 6 lakhs

Impact on Homebuyers and Homeowners

Refinancing Activity Surges

The drop to one-year lows has triggered a massive surge in refinancing applications. According to the Mortgage Bankers Association, refinance demand has jumped 81%-111% year-over-year as borrowers take advantage of lower rates.

“Refinancing could make sense if rates have dropped since you first took out your mortgage,” advised Bankrate mortgage analysts. “But even though rates are coming down, they’re still higher than those super-low pandemic-era rates”.

Who Should Refinance?

Experts generally recommend refinancing if you can lower your rate by at least 0.75-1.0 percentage points and plan to stay in your home long enough to recoup closing costs.

“If you’re holding a mortgage rate around or above 7%, you could see significant savings by refinancing this year,” says mortgage expert Shashank Shekhar. “However, if your rate is 6.5% or lower, it might make sense to wait”.

Importantly, 70% of American homeowners with mortgages have rates below 5%, meaning the vast majority won’t benefit from refinancing at current levels. These homeowners are instead turning to home equity lines of credit (HELOCs) and home equity loans to access their home equity without giving up their low mortgage rates.

Home Equity Products See Increased Interest

With refinancing less attractive for most existing homeowners, HELOCs and home equity loans have become popular alternatives for accessing cash. These products allow homeowners to borrow against their home equity while maintaining their existing low-rate mortgage.

“The length of your home equity loan will impact your rate. The longer the loan, the higher the rate,” explained mortgage expert Robert Kates.

New Homebuyers Get Modest Relief

For prospective homebuyers, the drop to 6.19% provides meaningful savings compared to rates earlier this year. On a $340,000 30-year mortgage, the difference between a 7% rate (where rates were at the start of 2025) and today’s 6.19% translates to approximately $180 per month in payment savings, or $64,800 over the life of the loan.

However, elevated home prices continue to offset much of the benefit from lower rates, keeping overall affordability challenging.

Government Shutdown Complicates Fed Decision-Making

A significant factor affecting both Fed policy and mortgage markets is the ongoing U.S. government shutdown, now in its 29th day, which has delayed the release of critical economic data.

The September employment report—typically one of the most important indicators for Fed decision-making—has not been released, forcing policymakers to rely on private-sector data and alternative indicators.

“The Fed is ‘flying blind’ regarding the current job market,” noted BBC economists, as the shutdown has also delayed Initial Jobless Claims data and other labor market indicators.

This data vacuum creates additional uncertainty for mortgage markets. “Uncertainty drives money into bonds, allowing rates to ease slowly,” explained Derek Egeberg, branch manager at MortgageOne. “As the government shutdown continues, expect rates to decrease as investors move toward bonds”.

What Comes Next: December Meeting and Beyond

The Fed’s next policy meeting is scheduled for December 9-10, 2025. Before then, key data releases will shape the central bank’s decision:

- November employment reports (including delayed September data)

- October and November CPI inflation readings

- Q3 GDP growth data

- Consumer spending indicators

Powell’s statement that a December cut is “far from a foregone conclusion” has already caused markets to reduce the probability of a December cut from 90% to 56%, suggesting the Fed may pause its easing cycle depending on incoming data.

Should You Lock in Today’s Rates?

Given the uncertainty about future rate movements, mortgage experts offer the following guidance:

Lock in your rate if:

- You’re actively house hunting and ready to close within 30-60 days

- You can lower your existing rate by at least 0.75-1.0 percentage points

- You plan to stay in the home long enough to recoup closing costs (typically 2-3 years)

Wait and monitor if:

- Your current rate is already below 6.5%

- You’re not ready to purchase for several months

- You have flexibility to time your purchase

“Rather than trying to make a strong bet on the future, I’d suggest those mulling refinancing use our online mortgage calculator as part of the process,” advised mortgage analyst James Tobin. “There’s also no cost in shopping around for the best rate”.

FAQs about Fed Rate Cuts and Mortgage Interest Rates

Q: Will mortgage rates drop below 6% in 2025?

Most experts predict mortgage rates will remain above 6% through the end of 2025, with potential gradual declines into 2026 depending on inflation trends and Fed policy. Rates could drop below 6% only if economic conditions significantly weaken or inflation falls much faster than expected.

Q: How much can I save with today’s lower mortgage rates?

On a $300,000 30-year mortgage, the difference between 7% (rates from early 2025) and 6.19% (current rates) is approximately $155 per month, or $55,800 over the life of the loan. Use a mortgage calculator with your specific loan amount to calculate your potential savings.

Should I refinance my 7% mortgage now?

Yes, if you currently have a rate around 7% or higher, refinancing to today’s rates around 6.2% could save you significant money. However, be sure to calculate your break-even point by dividing total closing costs by your monthly savings to ensure you’ll stay in the home long enough to benefit.

Why did mortgage rates rise after the Fed cut rates?

Mortgage rates follow the 10-year Treasury yield rather than the Fed’s federal funds rate directly. Treasury yields can rise even after Fed cuts if investors expect higher inflation, stronger economic growth, or increased government borrowing. Market expectations matter more than the Fed’s actions alone.