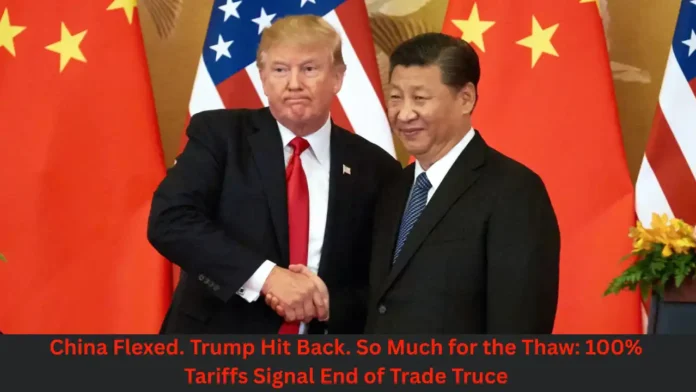

In a dramatic turn of events on October 10, 2025, President Donald Trump announced a sweeping 100% tariff increase on Chinese imports, effectively ending the brief trade thaw after China imposed rare earth export controls—actions that unfolded in Washington and Beijing and reverberated across global markets.

Read Also: Nobel Prize 2025: Announcing the Winners and Their World-Changing Contributions

Background and Context

The tentative détente between Washington and Beijing this year collapsed when China flexed its dominance over critical rare earth minerals by restricting exports, prompting Trump to hit back with unprecedented tariffs. Rare earth elements, vital for electronics, defense, and clean-energy industries, gave China significant leverage. The announced tariffs, effective November 1, 2025, add to existing duties and include possible U.S. export controls on advanced technologies.

- China’s export curbs target minerals like neodymium and dysprosium.

- Trump’s 100% tariff hike impacts over $300 billion in imports.

- Planned Trump-Xi summit in South Korea now faces cancellation risk.

Read Also: Truth and Dare Game – Friend & Family

Expert Opinions and Public Reactions

Analysts warn that China’s move was a strategic gamble that backfired, while U.S. commentators view Trump’s response as predictable.

- Craig Singleton called China’s export policy “overplaying its hand.”

- Former Global Times editor Hu Xijin accused the U.S. of “hidden hostility.”

- Investors shifted from tech stocks to gold amid market volatility.

Read Also: Compare Your Age with BTS Members

Future Implications

The renewed trade conflict threatens global supply chains, particularly in semiconductors and renewable energy. Key developments to watch:

- Supreme Court review of presidential tariff authority.

- Status of Trump-Xi summit and broader diplomatic ties.

- Corporate strategies for sourcing critical minerals outside China.

FAQs about China Flexed and Trump Hit Back

Q1: What triggered the latest U.S.-China tariff escalation?

Trump’s announcement of a 100% tariff increase on Chinese imports followed China’s rare earth export controls, ending the brief thaw.

Q2: Which industries are most affected?

Electronics, defense, electric vehicles, and renewable energy sectors reliant on rare earth minerals face supply and cost pressures.

Q3: How have global markets reacted?

Major U.S. stock indices fell sharply, technology shares led declines, and gold prices rose as investors sought safe havens.

Q4: Is the Trump-Xi summit still on?

The planned South Korea meeting is in doubt, with White House signals suggesting a possible cancellation amid rising tensions.